Managing a business requires balancing operations, finances, and client relations, often with little staff and time. Intuit has launched AI-powered agents for QuickBooks to help businesses automate repetitive tasks and boost productivity, revolutionising the way small and mid-sized businesses run their daily operations.

Beyond being passive tools, these new “agentic AI” capabilities actively carry out essential tasks in marketing, finance, and customer operations, giving expanding companies enterprise-level functionality.

Relevvo, an AI startup that specializes in dynamic go-to-market automation, was recently acquired by Intuit, further solidifying this vision. With this change, QuickBooks marks its evolution from a conventional business software program to an independent operating platform intended for business-to-business (B2B) e-commerce, sales, and customer interaction.

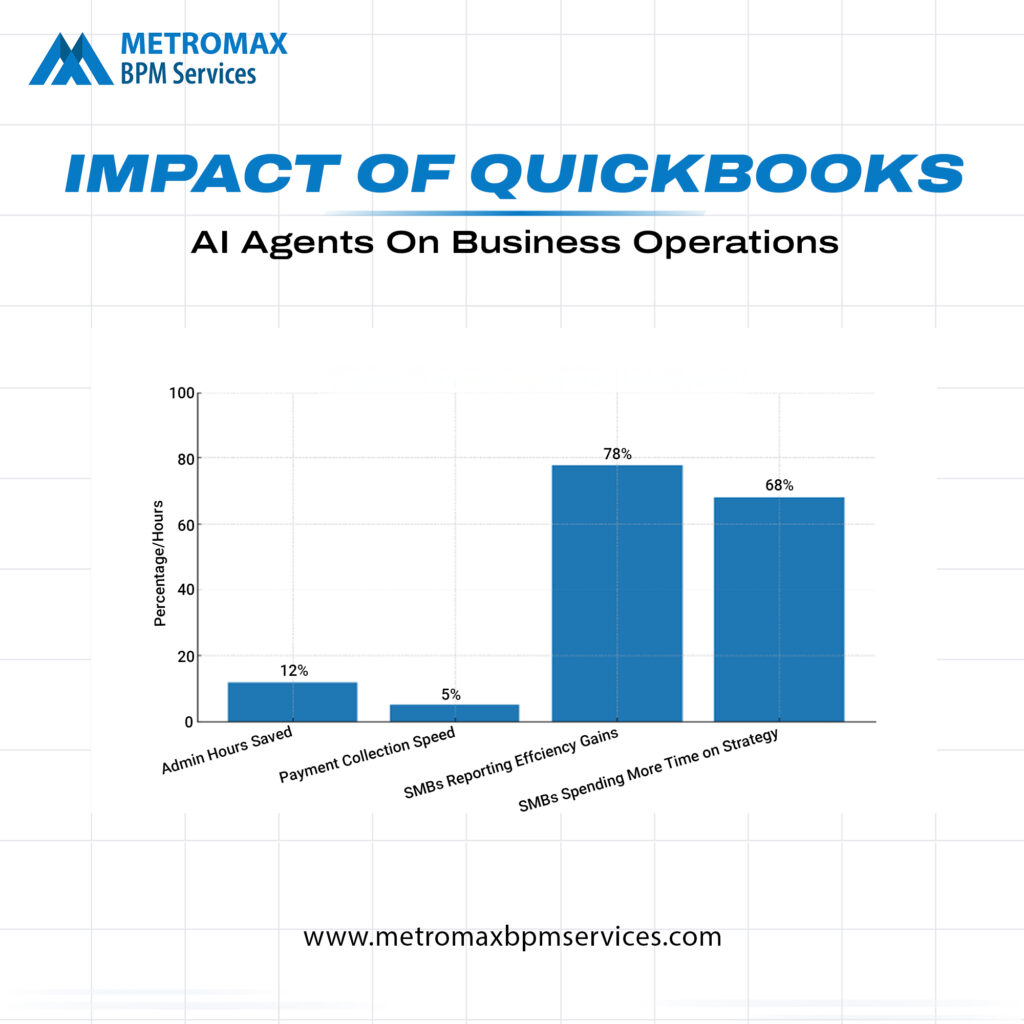

Businesses can benefit from these integrated tools in the following ways:

- Reduce the amount of manual labour by up to 12 hours each month.

- Increase payment collection time by five days.

- Increase operational efficiency by 78%.

- Increase your time spent on strategic tasks by 68%.

Let’s examine each Intuit QuickBooks AI Agent’s operation, significance, and implementation with professional assistance.

What Are AI Agents For QuickBooks And Why Should You Study Them?

QuickBooks AI Agents are integrated automation tools that act on your behalf. These agents actively manage tasks like bookkeeping, invoicing, sales outreach, and cash flow forecasting, in contrast to passive features that merely display data.

These agents, which are integrated into the updated QuickBooks web and mobile apps, operate from a single interface that connects real-time business data from various departments, facilitating better collaboration, workflow management, and KPI viewing.

Knowing how these agents operate offers your company a competitive edge. Early adoption will help you cut costs, increase accuracy, and compete more successfully in your sector.

Reasons to study them:

- These agents are fully integrated with QuickBooks and don’t need any extra platforms or subscriptions.

- Because each agent is made to perform tasks on its own, less manual supervision is required.

- Companies that use AI-powered accounting software say they save an average of 12 hours every month.

- These resources give you up-to-date information to help you make quicker, more intelligent decisions.

- AI is quickly changing how small businesses run, so learning about it now will help you future-proof your procedures.

AI Agent 1: Collect Payments Faster With The Intuit QuickBooks Payments Agent

Managing past-due payments can take up a lot of your time and money. That’s why QuickBooks’ Payments Agent streamlines your accounts receivable process, eliminating the need for manual reminders or follow-up emails and enabling you to get paid more quickly.

What this agent can do for your company is as follows:

- To ensure you never miss a follow-up, it automatically tracks invoice due dates and flags past-due payments.

- Reduces friction and increases customer response rates by sending human-feeling, personalised payment reminders.

- Improves liquidity and cash availability for other operations by cutting down on the average time it takes to collect payments by up to five days.

- Helps you prioritise follow-ups and better manage credit risk by tracking payment history and behaviour patterns.

Intuit claims that this can guarantee a healthier cash flow and quicker collections while also greatly reducing overall payment cycles.

AI Agent 2: Keep Your Books Accurate With The Intuit QuickBooks Accounting Agent

Manual bookkeeping is not only laborious but highly prone to numerous mistakes and errors. For that purpose, every financial entry is precisely tracked, categorised, and reconciled automatically by the accounting agent.

Your financial accuracy is improved by this agent:

- Using your chart of accounts to automatically classify transactions like software subscriptions, payroll, fuel, and auto maintenance.

- Real-time detection of anomalies or duplicate entries lowers the possibility of human error or noncompliance during audits.

- Closing monthly books up to 40% more quickly enables you to use more recent data when making financial decisions.

- Offering a centralised dashboard that eliminates the need for spreadsheet updates so you can quickly view your cash flow, expenses, and trends.

As Intuit had envisioned with its AI-powered ecosystem, this feature enables expanding businesses to maintain audit-readiness and clear financial visibility with little intervention.

AI Agent 3: Plan Smarter With The Intuit QuickBooks Finance Agent

Understanding the performance of your company is truly essential, but manually collecting and evaluating that data can be difficult. That’s why the Finance Agent instantly transforms complicated financial data into clear, useful insights.

Here are some ways that this AI agent can improve your business plan:

- Provides interactive dashboards that include real-time KPIs to help direct daily decisions, including cash reserves, profit margins, and expense breakdowns.

- Helps you avoid shortages or overspending by offering cash flow projections and budget recommendations based on historical data.

- Compares your performance to peers in the industry using anonymised data, giving you a more precise way to gauge growth.

- Determines high-cost areas and suggests areas for reduction or reinvestment to achieve optimal profitability.

These features, which are essential to Intuit’s strategy for assisting businesses in operating with greater accuracy and agility, enable mid-market firms to proactively forecast for growth and compare themselves to industry standards.

AI Agent 4: Convert More Leads With The Intuit QuickBooks Customer Agent

Undoubtedly, customer relationships drive revenue. However, it can be challenging to stay on top of outreach and follow-ups. Within the QuickBooks environment, the Customer Agent assists with lead management, communication scheduling, and closing more deals.

The main advantages are as follows:

- Ensures that no discussion or question is overlooked by automatically recording and organising customer and lead interactions.

- Allows you to stay at the forefront of your mind without having to keep track of every opportunity by scheduling follow-ups according to lead behaviour.

- Increases interaction through tailored outreach by offering communication ideas and message templates.

- Enhances lead conversion rates by as much as 29%, particularly for companies that offer expensive services or repeat customers.

Based on real-time behavior, these AI-powered customer tools also work with Relevvo’s technology, which Intuit purchased, to enhance outreach and give priority to high-value accounts.

AI Agent 5: Market Smarter With The Upcoming Intuit QuickBooks Marketing Agent (To Be Released)

For automating your outreach efforts, Intuit is creating the Marketing Agent, an AI-powered campaign tool that will link QuickBooks and Mailchimp.

It will provide the following when it is released:

- Segmenting your customer base in real time so that each message is customised based on particular buyer behaviours or past purchases.

- Even without a marketing team, you can launch high-quality campaigns with AI-generated campaign content that matches your brand tone.

- Campaign triggers that run automatically in response to consumer actions like paying invoices, making new purchases, or renewing services.

- Email performance monitoring that helps you improve your messaging strategy by displaying open and click-through rates.

By integrating Mailchimp and Relevvo, Intuit will transform this AI agent into a comprehensive go-to-market automation tool for small and medium-sized enterprises.

Real-World Use Cases Of QuickBooks AI Agents (Backed By Results)

The primary goal of small and mid-sized businesses implementing AI must be to keep up, instead of staying ahead. Numerous businesses are already enjoying the advantages of AI-powered accounting, customer support, and financial forecasting since QuickBooks now has built-in automation.

QuickBooks is now positioned by Intuit as a comprehensive digital operations platform for B2B sales, customer support, and e-commerce automation, rather than merely an accounting solution.

Let’s examine how companies are utilising these agents in practice and the financial benefits they are experiencing.

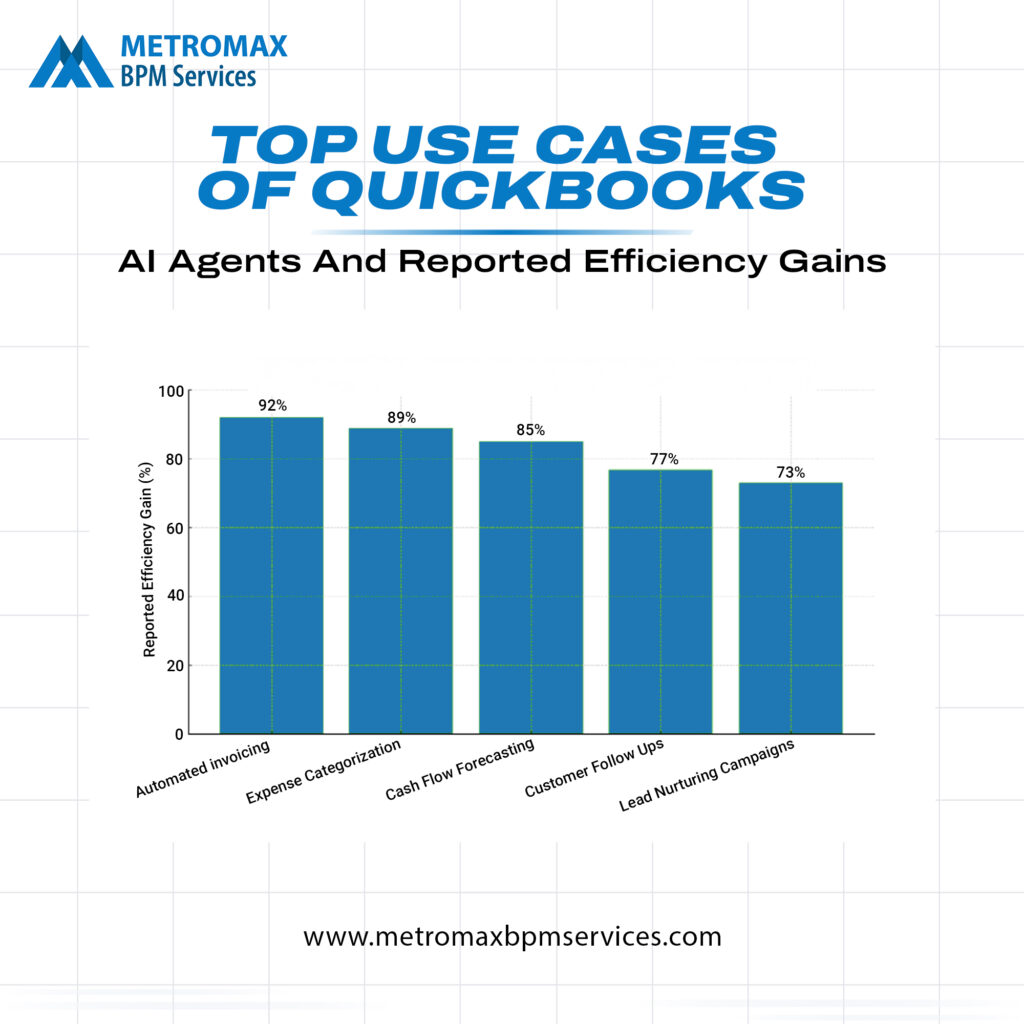

The most important applications of AI automation in QuickBooks

Here are the top five areas where using QuickBooks AI Agents is helping businesses:

Automated Invoicing: 92% of respondents said that automated invoicing resulted in quicker billing and payment follow-ups.

From sending invoices to reminding customers of deadlines, the Payments Agent automates the process.

- Companies experienced fewer unpaid invoices and much faster billing cycles by over 30%.

- By eliminating the need to manually pursue payments, teams were able to save hours every week.

Expense Categorisation: 89% of respondents said their books were cleaner and had fewer mistakes.

Businesses no longer waste time tagging each transaction when they use the Accounting Agent.

- It instantly and precisely classifies routine expenses, such as payroll, software, and travel.

- This facilitates tax season and enhances the quality of reporting.

- Additionally, it lessens human error, which can result in problems with compliance.

Cash Flow Forecasting: 85% of them had better financial planning.

The Finance Agent transforms unprocessed data into meaningful insights.

- Cash flow projections are available to users weeks or months in advance.

- Alerts let you know when there might be gaps or extra money that could be invested.

- This has assisted companies in avoiding making bad decisions about expansion or major purchases at the wrong time.

Customer follow-ups: Customer follow-ups increased lead response and client retention by 77%.

Your virtual CRM assistant is the customer agent.

- Every client interaction is automatically recorded, so you can remember who to follow up with.

- It plans outreach reminders and even makes recommendations for when and how to get back in touch.

- Companies reported more prompt follow-ups and improved customer engagement.

Lead Nurturing Campaigns: 73% of prospects showed increased engagement.

Lead generation becomes more intelligent with the upcoming Marketing Agent (powered by Mailchimp).

- Based on behaviour, it divides up the audience into segments and tailors follow-ups.

- Email opens and responses skyrocketed for companies utilising early versions.

- Your messaging is always pertinent because campaigns are triggered by actual occurrences, such as quotes, payments, or service usage.

Efficiency Gains From AI Use Cases

A brief comparison of these use cases’ reported significant improvements as observed below:

The percentage of users who reported increased productivity in each area following the implementation of QuickBooks automation is displayed in this graph. Forecasting, expense management, and invoicing are at the top of the list, but each agent produces a quantifiable return on investment.

These agents can drastically cut down on back-office workloads, freeing up your team to concentrate on achieving results, whether you’re managing a FedEx ISP route, an Amazon DSP operation, or an independent logistics business.

How MetroMax BPM Helps You Implement And Maximise QuickBooks By AI Agents

To help you get the most out of QuickBooks AI Agents, MetroMax BPM provides individualised support. We customise the software to meet your specific requirements in addition to assisting with installation.

What we offer is as follows:

- QuickBooks setup that is specific to your reporting structure, expenses, and workflows.

- All available AI agents, including those for payments, accounting, finance, and customer management, can be configured seamlessly.

- Providing your internal team with training sessions to ensure they are all proficient with the tools

- Continuous optimisation and support to ensure your system keeps expanding along with your company

With MetroMax BPM, you can use AI to create a more intelligent and flexible company.

Conclusion

QuickBooks AI Agents are transforming how companies run their operations. They facilitate quicker and easier decision-making, streamline bookkeeping, increase customer engagement, and speed up collections.

Intuit is transforming QuickBooks as the preferred platform for back-office automation and business-to-business expansion by incorporating agentic AI, Relevvo technology, and unified data access through redesigned interfaces.

In addition to saving time, automating these fundamental tasks lowers risk, enhances cash flow, and puts your company in a position to grow.

QuickBooks AI Agents provide small and mid-sized businesses with enterprise-grade automation without the enterprise-level complexity, thanks to Intuit’s innovation and long-term vision.

Additionally, you can bypass the learning curve and begin seeing results right away through the MetroMax BPM implementation expertise.